What is ATE Insurance and its role in Litigation Funding?

After-the-Event (ATE) insurance is a specialised insurance product that mitigates the financial risks inherent in litigation. It’s an important security tool for litigation funders and it significantly enhances the appeal of litigation funding.

What is ATE Insurance?

ATE insurance covers the legal costs and expenses associated with litigation if a funded case is unsuccessful. An ATE policy is taken out after a dispute arises and insures claimants against the potential risk of losing the case and having the associated liability to pay their opponent’s legal costs as well as their own incurred costs and disbursements.

Understanding ATE Insurance: Coverage, Costs and Process

ATE insurance is a unique insurance product designed specifically for litigation costs. Unlike traditional insurance, it is purchased after a legal dispute begins.

What Does ATE Insurance Cover?

- Opponent’s Legal Costs: Covers legal fees and expenses payable to the opposing party if the case is unsuccessful.

- Own Disbursements: Covers the necessary litigation expenses incurred during the case, such as court fees and expert reports.

- Lawyer’s Fees: Some ATE policies may offer partial coverage for the claimant’s own legal fees.

Premiums

ATE insurers thoroughly evaluate a law firm’s track record and the strength of individual cases before offering a policy. Premiums are calculated based on factors such as case complexity, potential loss costs, and the likelihood of success. Depending on the insurer, premiums may be payable upfront or deferred with deferred premiums deducted from the successful claimant’s compensation. In the event of a loss the premium is not payable since it is self-insured by the policy.

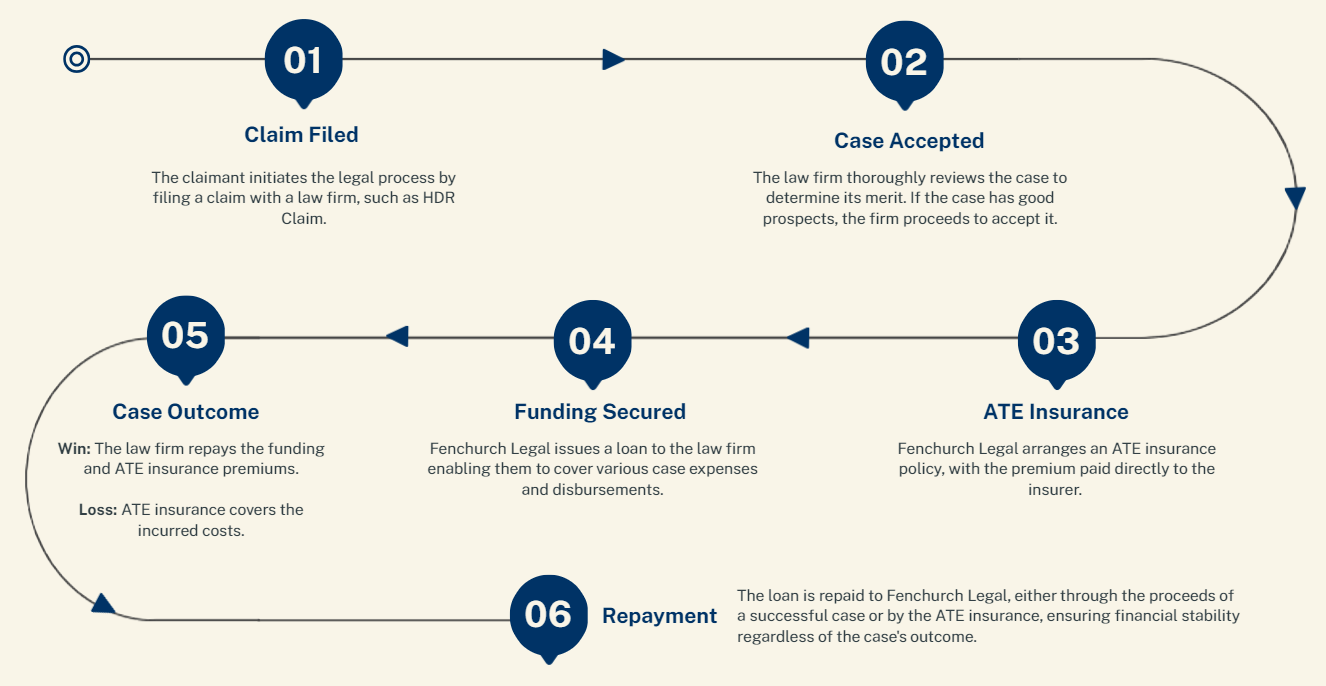

Fenchurch Legal’s Process

Fenchurch Legal requires ATE insurance to be in place before providing funding. We advance the premium directly to the ATE insurer, ensuring coverage for each funded case and take assignment of the ATE Insurance Policy for added security.

The Benefits of ATE Insurance for Lawyers & Claimants

Without ATE insurance, the fear of large legal costs can prevent valid claims from being pursued. ATE insurance removes this barrier, allowing litigation cases to proceed based on legal merit rather than financial resources. It offers several benefits:

- Mitigating Financial Risks: Transfers the risk of adverse costs to the insurer, allowing law firms to pursue cases with confidence.

- Access to Justice: Enables claimants with limited resources to pursue valid cases and challenge well-funded opponents, promoting access to justice for all.

- Increased Caseload: Provides a safety net for law firms to undertake more meritorious cases that might be challenging due to financial constraints.

The Benefits of ATE Insurance for Litigation Funders

ATE insurance is crucial for litigation funders as it manages risk. It creates a viable investment by protecting the funder’s capital and the claimant from potential financial losses if the litigation case is unsuccessful.

Even for small-ticket funders like Fenchurch Legal who specialise in lower-value litigation cases at high volumes, ATE insurance remains essential for every case. Our track record of funding over 12,000 cases, all with active ATE policies, demonstrates this commitment to risk mitigation.

In smaller claims, the potential adverse costs might seem minor on a on case-by-case basis, however, for litigation funders managing a portfolio of cases, even smaller costs can add up, putting strain on their ability to fund other worthy claims. ATE insurance provides a safety net, protecting investor capital and ensuring continued access to funding for claimants.

ATE Providers

There are many ATE insurance providers in the market and choosing an experienced ATE insurer with a proven track record is essential. To diversify risk and ensure comprehensive coverage, Fenchurch Legal partners with three leading ATE insurers, renowned for their expertise and reliability in the legal insurance industry.

Conclusion

ATE insurance has become a vital tool for both lawyers and litigation funders. For lawyers, it removes financial barriers preventing clients from seeking justice. For funders, it offers vital security, making investments in litigation more feasible and attractive, especially for smaller claims. By mitigating risk and promoting access to justice, ATE insurance plays a crucial role in ensuring a fairer and more accessible legal system.

For more information on our funding solutions or litigation funding investment opportunities, please contact us.