Small Ticket Litigation Funding vs Large Ticket Litigation Funding

The litigation funding market has gained significant attention in recent years, attracting investments from both High-Net-Worth Individuals and Institutions seeking alternative investment returns. While large ticket litigation funders like Burford and Augusta dominate the headlines with class actions and multi-million-pound settlements, a distinct and dynamic segment thrives: Small Ticket Disbursement Litigation Funding. Understanding the nuances of these two approaches is important for informed investment decisions.

WHAT IS SMALL TICKET DISBURSEMENT LITIGATION FUNDING?

Unlike their large-scale counterparts, small-ticket funders focus on quantity, funding a high volume of smaller cases. These case types have clear legal precedent, are protocol based and process driven consumer claims, with high success potential. This approach effectively spreads the risk across various law firms, multiple cases and case types, reducing the reliance on the success of a single case.

The funded cases include personal injury claims, housing disrepair claims, financial mis-selling claims and other smaller-scale legal battles that might not attract the attention of larger litigation funders.

In summary, small ticket high volume litigation funding, provides several advantages:

- Diversification: Mitigates risk by reducing exposure to any single case’s outcome.

- Accessibility: Offers lower entry points for investors compared to large ticket funds.

- Broader market access: Taps into a wider range of legal issues and disputes.

WHAT IS LARGE TICKET LITIGATION FUNDING?

Large ticket funders specialise in high-stake cases such as class actions with the potential for multi-million-pound settlements offering significant gains for investors. However, it’s crucial to acknowledge the inherent risks associated with this concentrated approach.

Firstly, the win-or-lose nature of these high-stakes cases amplifies potential losses. Unlike small ticket funding’s diversified portfolio, success hinges on a few select cases. A single unfavourable outcome can significantly impact overall returns.

In summary, large ticket funding offers the potential for high returns but comes with inherent risks:

- Concentrated risk: Success relies on a few select cases, amplifying potential losses.

- High entry barriers: Requires significant capital investments due to the high costs involved.

- Limited access: Targets a narrower range of legal issues and disputes.

AFTER THE EVENT INSURANCE

Both segments traditionally utilise after-the-event (ATE) insurance to manage risk. This specialised insurance protects investors against adverse costs and disbursements if a funded case is unsuccessful. For large ticket funders, ATE premiums represent a significant portion of the overall funding cost. For small ticket funders, while still relevant, the smaller individual case sizes limit the proportional impact of ATE premiums, potentially offering a more favourable risk-reward profile.

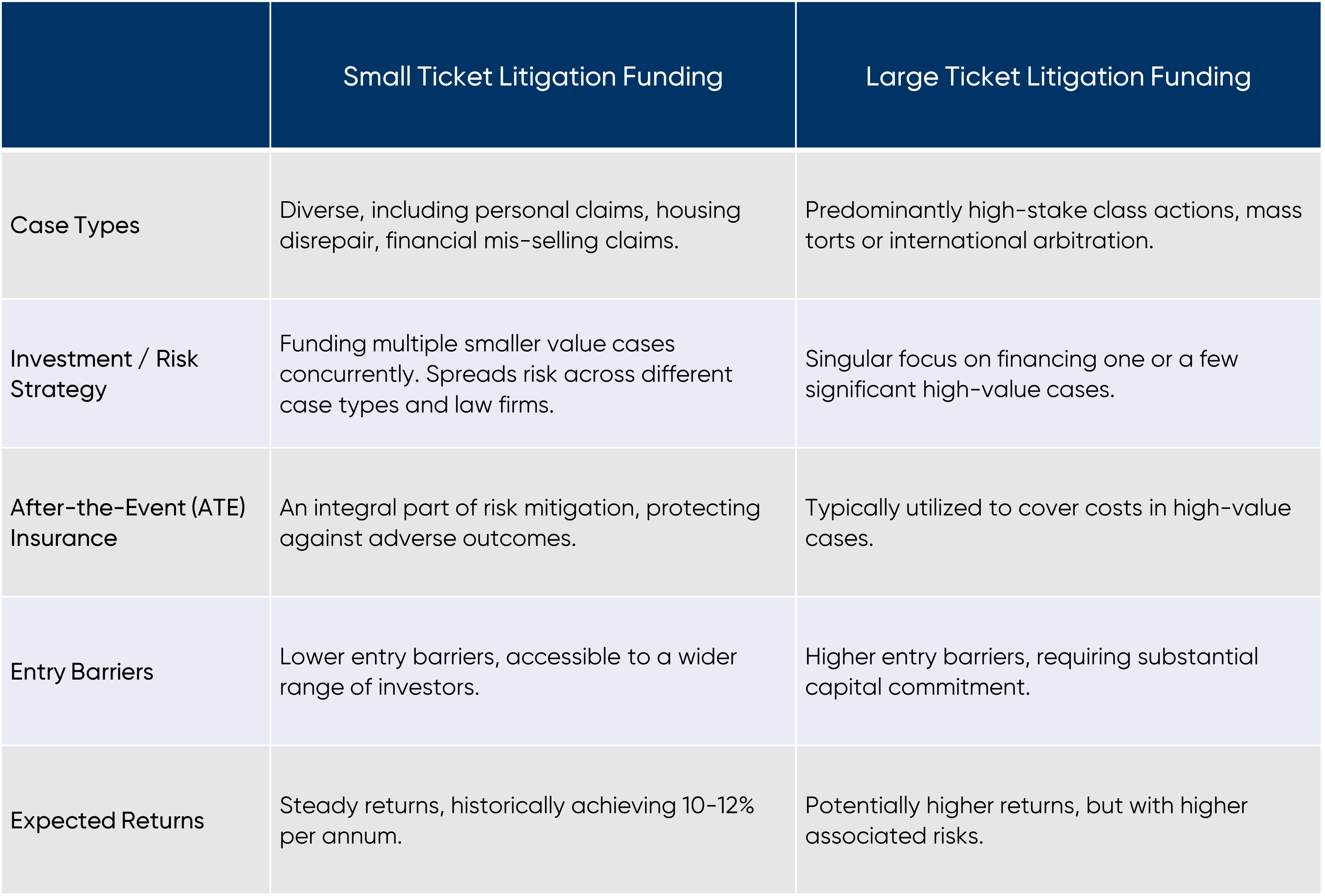

AT A GLANCE: COMPARING KEY FEATURES

INVESTMENT CONSIDERATIONS: TAILORING YOUR STRATEGY

For investors, understanding these distinctions is crucial for making informed investment decision. Each approach caters to different risk tolerances and investment goals.

- Large ticket funding: Ideal for investors seeking potentially larger returns, comfortable with concentrated risk, and possessing significant capital but with higher entry barriers.

- Small ticket funding: Suitable for investors seeking diversification, lower risk profiles, access to a broader market, and lower entry points. Suitable for investors seeking a more balanced approach with steady returns.

Ultimately, the optimal choice depends on individual risk tolerance and investment goals. By carefully considering the nuances of each segment, investors can navigate the litigation funding landscape and unlock opportunities aligned with their unique requirements.

EXPLORING THE POTENTIAL OF SMALL TICKET DISBURSEMENT FUNDING

As the market evolves, investors are increasingly recognizing the potential of small ticket disbursement funding as a strategic alternative. Fenchurch Legal’s emphasis on smaller-ticket claims, flexible entry points, and robust security features makes it an accessible and appealing choice for investors seeking to explore this dynamic market.

If you want to explore further the potential of litigation funding and how Fenchurch Legal can be a valuable addition to your investment strategy, then get in touch for more information.